I. Cause of the incident

On February 1, 2025, the U.S. suddenly announced 25% tariffs on Canadian and Mexican imports (10% on energy products), then reinstated 25% tariffs on steel and aluminum globally and lifted exemptions for allies such as the EU, claiming to “protect local industries” and “address fentanyl smuggling,” but was widely seen as an act of trade protectionism. “This was widely seen as protectionist behavior.

II. Specific Measures

1. Scope of tariffs:

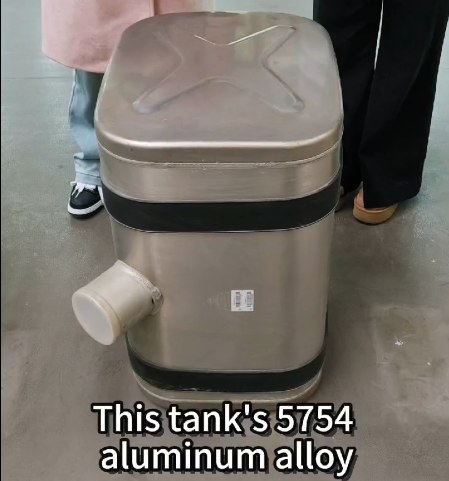

o Canada: C$155 billion in steel, aluminum products and other goods are subject to a 25% tariff increase, and another 10% on energy products.

o EU: 25% tariff increase on steel and aluminum products across the board, including terminal aluminum products (e.g., auto parts, building materials).

2. Retroactive clause: the US requires tariffs to take effect retroactively from March 2024, when the investigation was initiated.

III. Chain Reaction

1. Canada forced to turn to the EU:

o Canada plans to expand aluminum exports to the EU in response to the U.S. tariffs, but may exacerbate oversupply in the EU market.

o Although the EU welcomes Canadian aluminum products, it faces challenges such as inconsistent internal tariff policies and competition from Russian aluminum products.

2. Industry chain turmoil:

o U.S. domestic aluminum prices have soared, increasing corporate costs by $1.5 billion to $2 billion and increasing the burden on consumers.

o Global copper and aluminum supply chain is in disarray, with 150,000 tons of copper inventory backed up in U.S. ports, and processing fees plummeting and even going negative.

3. Countermeasures and protests:

o Canada imposed 25% retaliatory tariffs on $107 billion of U.S. goods (steel, food, etc.).

o The EU complained to the WTO and threatened to raise tariffs on U.S. agricultural products, whiskey, etc.

IV. Future Trends

1. Short-term game: Canada and the EU are negotiating for exemptions, but the U.S. insists on “tariffs in exchange for concessions,” and progress in negotiations is limited.

2. Long-term impact:

o North America, Europe, industrial chain costs rise, may lead to enterprises to move to Southeast Asia or South America. o Global trade rules to accelerate the reconstruction, the United States, the United States, the United States and other countries.

o Accelerated restructuring of global trade rules, high tariffs may trigger more countries to follow suit, exacerbating trade protectionism.

The tariff war is ostensibly “national security” and “industrial protection”, but in fact the United States to compete for global metal pricing power, reshaping the supply chain of political operations, its impact has far exceeded the economic sphere.