Ⅰ. Background

On April 22, 2024, the Mexican government suddenly announced that it would impose temporary tariffs ranging from 5% to 50% on 544 categories of imports, with the highest rate on Chinese aluminum products reaching 35% (and even 50% on some steel products). Officially, this is to “protect the domestic manufacturing industry”, but the reality is clearly aimed at Chinese products - China accounted for more than 40% of Mexico's aluminum imports at the time.

Ⅱ. the specific measures

1. Scope of the tax increase:

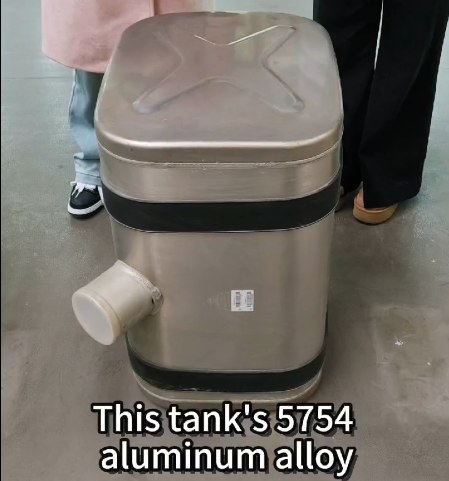

Aluminum plate, aluminum tubes and other basic aluminum to impose 25% ~ 35% tariffs

30%~35% tariffs on finished products such as aluminum doors, windows, and automobile parts

2. Retroactive provisions: tariffs effective immediately from April 23, and requires customs to strictly investigate the “gray customs clearance” behavior of low-cost declarations.

Ⅲ.Direct Impact

1. Soaring costs for enterprises:

Chinese aluminum companies exported to Mexico, the cost of an average increase of 30%, some low-profit products were forced to give up orders

Mexico's local aluminum prices rose 18% in three months, automobile factories, building materials merchants complained about the pain.

2. Confusion in the supply chain:

A large number of Chinese aluminum stranded in Mexican ports, customs clearance time stretched from 3 days to 15 days

Part of the Chinese enterprises to Vietnam, Malaysia to set up factories “bypass exports”, but the cost of transportation increased by 20

Ⅳ. how to deal with enterprises

1. Adjust export strategy:

focus on shifting to high value-added aluminum deep processing products (such as aluminum for new energy vehicles)

joint venture with local enterprises in Mexico to enjoy tariff reductions and exemptions

2. Legal means:

Through the Mexican courts to sue the tariff policy “violation of trade agreements”, the enterprise has successfully fought for a half-year buffer period